More content

-

December 27, 2023 -

Our Barclays Story

There’s no better place in which to build your future. Find our more here.

February 12, 2024 Article Hygiene content Hub -

Be you. Be valued. Belong.

At Barclays, you’ll be valued for who you are, and you’ll be part of a community where you’ll truly belong.

February 12, 2024 Article Employee Resource Groups Hub -

This is me

Find inspiration in the real-life stories of our colleagues who don’t just fit in at Barclays, they belong.

February 26, 2024 Article People Stories Hub -

Be your best at Barclays

At Barclays, we’re committed to giving you the tools and support to be your best, whatever this looks like for you

February 12, 2024 Article Culture Related Content -

Employee Story

Hear from Rob, Head of Prague Technology Centre.

December 27, 2023 Article People Stories Hub -

Ambika, Director, Risk Services

Read about Ambika's experience in Risk as she strives to grow and be challenged

December 28, 2023 Article People Stories Hub -

Christina, Managing Director, Market Risk

Learn about Christina’s journey to become a Managing Director in Investment Banking

December 28, 2023 Article People Stories Hub -

Eleanor Flanagan, Vice President, Wholesale Credit Risk

Discover the meaningful work Eleanor does in Wholesale Credit Risk.

December 28, 2023 Article People Stories Culture Hub -

Elizabeth, Vice President, Risk Information Services

Hear from Elizabeth and how she is able to work flexibly to manage her family and work life.

December 28, 2023 Article People Stories Culture Hub -

Hinal, Director, Risk Transformation and Model Control

Learn more about Risk from Hinal, a Director in Risk Transformation

December 29, 2023 Article People Stories Culture Hub -

Learn more about Dale Cochran, Chief Risk Officer, US Consumer Bank

Hear from Chief Risk Officer for the US Consumer Bank, Dale Cochran

December 29, 2023 Article People Stories Culture Hub -

Linda, Chief Control Officer

Learn about Linda's role as a Chief Controls Officer.

January 08, 2024 Article People Stories Culture Hub -

Empowering Leaders Fellowship

Empowering Leaders Fellowship

January 09, 2024 Article Hub -

US Customer Service

Learn more about our customer service opportunities in the US.

February 26, 2024 Article Business overview Related Content -

Graduates and Interns

Launch your career, define your future

February 27, 2024 -

Graduate programmes

Graduate programmes

February 27, 2024 -

Graduate programmes - Data & Analytics

Graduate programmes - Data & Analytics

February 28, 2024 -

Graduate programmes - Investment Banking

Graduate programmes - Investment Banking

February 28, 2024 -

Quantitative Analytics

Our Quantitative Analysts are an integral part of the bank, providing model development, analytics and expert advice across various business areas at Barclays.

February 28, 2024 -

Graduate Programme - Developer

Graduate Programme - Developer

February 28, 2024 -

Graduate programmes - Enabling functions

Graduate programmes - Enabling functions

February 29, 2024 -

Internship Programmes

Internship Programmes

February 29, 2024 -

Losing a child but not being alone

Losing a child but not being alone

March 15, 2024 Article People Stories Hub -

March 19, 2024 -

Customer Care | Better never rests

We’re building a better bank. Better for our customers. Better for our colleagues. Better for everyone.

March 19, 2024 Article Culture Related Content - JD -

Barclays Prague

A tech-first centre of excellence, we take on complex challenges that have an impact on a global scale.

March 26, 2024 -

April 19, 2024 -

Insight days

Great ideas drive us forward - we know that they’re born from diverse perspectives.

February 28, 2024 -

Graduate programmes - Markets & Research

Graduate programmes - Markets & Research

February 28, 2024 -

Markets

Markets is the financial barometer of world events at Barclays.

February 29, 2024 -

Internships - Data and Analytics

Internships - Data and Analytics

February 29, 2024 -

Internships - Enabling Functions

Internships - Enabling Functions

February 29, 2024 -

Internships - Quantitative Analytics

Internships - Quantitative Analytics

February 29, 2024 -

Explore our Northampton Campus

Explore our Northampton Campus

February 29, 2024 -

Barclays in the UK

Discover where you’ll work, explore our office locations across the UK

March 01, 2024 Article Location overview Related Content Related Content - Search Results -

March 27, 2024 -

Business Area Spotlight

Explore opportunities in the Chief Controls Office.

December 21, 2023 Article People Stories Hub -

Technology Spotlight

An award-winning Women in Tech network.

December 29, 2023 Article Tech Related Content - Tech -

Risk. The Difference is Barclays.

Discover how risk is integral to the breadth and ambition of Barclays, which is engaged in every facet of the banks operations.

January 04, 2024 Article Business overview Hub -

Technology Spotlight

Customer-obsessed tech that delivers help when and where it’s needed most.

January 10, 2024 Article Hygiene content Hub -

Technology Spotlight

Fast-moving tech apprenticeships, earn while you learn, and transform tech

January 10, 2024 Article Early Careers Tech Related Content - Tech -

Technology Spotlight

DevOps visionary thinking

January 10, 2024 Article People Stories Tech Related Content - Tech -

Technology Spotlight

Hackathons that change lives, the chance to make a difference.

January 10, 2024 Article People Stories Tech Related Content - Tech -

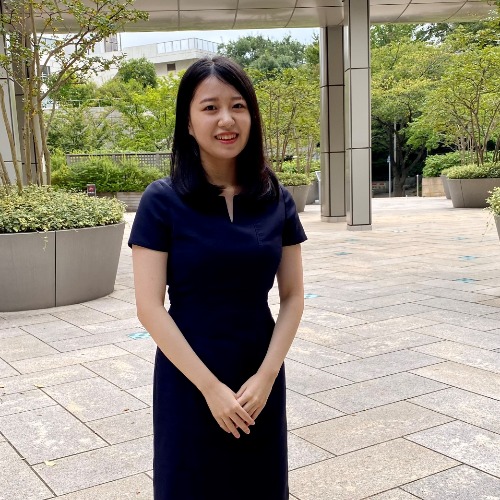

琴音, グローバル市場

グローバル市場における琴音の役割について学ぶ

January 24, 2024 -

Japan Investment Banking | 投資銀行部門のビジネス

Career opportunities in Japan Investment Banking. 投資銀行部門のビジネス

January 24, 2024 Article Location overview Related Content - Search Results -

Technology Spotlight

Million-dollar innovation, constant change, everyday champions.

January 29, 2024 Article Tech Related Content - Tech -

Limitless opportunity. It’s happening here.

Opportunities that just keep getting bigger and better. It’s happening here.

January 29, 2024 Article People Stories Tech Related Content - Tech -

Analytics Opportunities

Analytics at Barclays is a place where the brightest and best can do their very best work. Find out more about Analytics Opportunities today

January 30, 2024 -

Barclays in EMEA

Discover where you’ll work, explore our office locations across Europe

March 01, 2024 Article Location overview Related Content Related Content - Search Results -

Barclays in the US

Discover where you’ll work, explore our office locations across the USA

March 02, 2024 Article Location overview Related Content - Search Results -

Barclays in Asia Pacific

Discover where you’ll work, explore our office locations across the Asia Pacific region

March 02, 2024 Article Location overview Related Content - Search Results -

Hear from Kristina , Lead Business Analyst, Prague

Hear how she is driving innovation and inclusivity in our Prague Technology Centre.

March 15, 2024 -

Demi, Corporate Banking Analyst

Learn from Demi's experience as an Analyst in Corporate Banking

March 15, 2024 -

Life Stories by Leanne

Discover Leanne’s journey to starting a family as a bisexual Black woman.

March 15, 2024 Article People Stories Hub -

Micaela, Risk Analyst

Read about Micaela's best experiences working in Risk

March 15, 2024 Article Early Careers Hub -

Find out how Abhinandan's tech career has taken him around the world

Abhinandan Shah - Director Enterprise Data Platforms Machine Learning

March 18, 2024 Blog Tech Related Content - Tech -

Jill’s story about becoming a lawyer in her forties.

Read Jill’s story about growing in the projects and becoming a lawyer in her forties.

March 18, 2024 Article People Stories Hub -

Grace Hopper Celebration 2023

Barclays are sponsoring this years Grace Hopper Conference, where members of our leadership team will be talking to the amazing women in tech attending.

March 18, 2024 Article Events Hub -

Anita shares her story on financial wellbeing

Hear how Anita from the Barclays Whippany Office manages her financial health with benefits such as pension schemes, saving plans and Employee Assistance Programmes to support with wellbeing at work

March 19, 2024 -

Support for your family when you need it

Wendy Hare is the Head of ICB UK KYC Onboarding. She shares her story on how the support and resources available through Barclays helped her daughter through illness and her family through a difficult time.

March 19, 2024 -

Jaimals journey with mental health after the pandemic

With a keen interest in mental health awareness and wellbeing, Jaimal shares his story on how the support from his family, friends and line manager helped him get his overall health back on track after the pandemic.

March 19, 2024 -

Adjustments to the recruitment process

How we support candidates during the recruitment process

March 27, 2024 -

Radbroke Campus

Learn about life in Radbroke

March 27, 2024 -

Micaela, Assistant Vice President, Operational Risk

Hear how Risk is an exciting place to work to drive organisational change.

December 27, 2023 Article People Stories Culture Hub -

Technology Spotlight

21 million transactions every Tuesday

December 29, 2023 Article Tech Related Content - Tech -

Technology Spotlight

People-focused proactive problem solvers

December 29, 2023 Article Tech Related Content - Tech -

Employee Story

Find out more about Arjun's journey from intern to AVP in Private Markets

December 29, 2023 Article People Stories Culture Hub -

Andrew Developer Degree Apprentice

Read how Andrew transitioned from policing to a Degree Apprenticeship

January 04, 2024 Article People Stories Culture Tech Hub -

Employee Story

Find out more about life as an Operations Apprentice

January 05, 2024 Article Culture Early Careers - Apprentice Related Content - EC -

Rosie Boyce Private Banking Graduate

Meet Rosie Boyce, Private Banking Graduate

January 05, 2024 Article People Stories Culture Hub -

Discover Barclays with Aneesah

Discover Barclays with Aneesah

January 05, 2024 Article People Stories Culture Hub -

Employee Story

Learn from Amy's experience as a Higher Apprentice in Technology

January 08, 2024 Article Early Careers - Apprentice Related Content - EC -

Barclays at Whippany, New Jersey

Exploring our Whippany Campus.

January 08, 2024 Article Location overview Related Content - JD -

Meet Customer Care Director, Sam

From Cashier, to Customer Care Director. Discover Sam's journey here

January 09, 2024 Article People Stories Culture Hub -

Women in Tech Leadership - Augusta

Meet our global head of operations and technology - Augusta

January 09, 2024 Article People Stories Culture Hub -

Employee Story

Learn how Elina is taking her career to new heights as part of our team in Prague

January 09, 2024 Article People Stories Hub -

Employee Stories

Unique opportunities in tech. It’s happening here.

January 09, 2024 Blog Early Careers Tech Related Content - EC -

Technology Spotlight

The future of money in the face of changing technologies

January 09, 2024 Blog Culture Tech Related Content - Tech -

Technology Spotlight

Intelligent automation, the perfect balance of people and automation.

January 10, 2024 Article People Stories Tech Related Content - Tech -

Women in Tech Leadership - Roopa

Meet our Global lead of Technology Strategy and Transformation for Corporate and Investment Bank - Roopa

January 10, 2024 Article People Stories Culture Hub -

Women in Tech Leadership - Sabina

Meet our Head of Employee and Banking Compliance Technology - Sabina

January 10, 2024 Article People Stories Culture Hub -

Glasgow Campus

Learn about life in Glasgow

January 11, 2024 Article Location overview Related Content - Search Results -

Explore a Barclays career with Joe

Explore a Barclays career with Joe

January 12, 2024 Video - Stand Alone People Stories Culture Hub -

Get to know Barclays with Jiali

Get to know Barclays with Jiali

January 12, 2024 Video - Stand Alone People Stories Culture Hub -

Employee Story

Read Ifeoluwa's story on the onboarding process at Barclays and the support she has had from day one

January 12, 2024 Article People Stories Culture Hub -

Employee Story

Hear Jennifer's story on how she helped colleagues future-proof their careers

January 12, 2024 Article People Stories Culture Hub -

Explore Barclays culture in India

A career at Barclays India could provide you with a new career challenge, a great work environment

January 12, 2024 Article Location overview Related Content - JD -

Yosuke, 投資銀行部門, アシスタントヴァイスプレジデント

バークレイズの投資銀行部門 東京オフィスを選んだ理由

January 24, 2024 -

Technology Spotlight

Taking tech the extra mile, it’s happening here.

February 06, 2024 Article Tech Hub -

Technology Spotlight

Using AI to fight fraud, its happening here

February 06, 2024 Article Tech Hub -

Technology Spotlight

Quantum and optical computing, the future of quantum physics

February 06, 2024 Article Tech Hub -

Technology Spotlight

Engineering with impact

March 05, 2024 Article Tech Hub -

Technology Spotlight

Engineering quality of life

March 05, 2024 Article Tech Hub -

Technology Spotlight

Cybersecurity, hear how tech makes the world a safer place

March 05, 2024 Article Tech Hub -

Technology Spotlight

Digital Financial Assistance

March 05, 2024 Article Tech Hub -

Technology Spotlight

Next-generation thinking for a sustainable future.

March 05, 2024 Article Tech Hub -

Technology Spotlight

The nanosecond that makes a difference.

March 06, 2024 Article Tech Hub -

Democratising Data

Transforming everything, evolving every day

March 06, 2024 Article Tech Hub -

Employee Stories

Meet Natalia Raclot, Frankfurt, Corporate Banking

March 06, 2024 -

Early Careers Application Process

Application hints and tips

December 21, 2023 Article Early Careers Hiring Process Related Content - EC -

Apprentice Application Journey

Find out how to apply to our Apprentice Programmes, and what to expect from the process

December 21, 2023 -

Barclays' Leading Women: Amy Williams

Amy discusses driving innovation that enables real change.

December 21, 2023 Article People Stories Hub -

Barclays' Leading Women

Sarah used her expertise as a Programme Director to help build the first app for Childline.

December 21, 2023 Article People Stories Hub -

Joe, Marketing Analyst

Learn how Marketing is full of opportunities to grow and succeed.

December 27, 2023 Article People Stories Culture Hub -

Mat, Business Apprentice

Mat's apprenticeship experience

December 27, 2023 Article People Stories Culture Hub -

Military Talent Scheme

Meet Joe, a Digital Project Manager

December 27, 2023 Article People Stories Culture Hub -

Nathalie, Customer Service Agent

Meet Nathalie, one of our Customer Service Agents supporting our Premier clients

December 27, 2023 Article People Stories Hub -

Experienced Hire Application Journey

What to expect during the application process

December 27, 2023 Article Hiring Process Related Content -

Hear from Martin Vavra, Electronic Trading Technology, Prague

Read more about Martin Vavra, Electronic Trading Technology VP, and his experience at our Prague Technology Centre.

December 28, 2023 Article People Stories Culture Hub -

Employee Story

Learn more about Milos and his role taking on global projects.

December 29, 2023 Article People Stories Culture Hub -

Barclays Military & Veterans Outreach

Barclays Armed Forces communities

December 29, 2023 Article Career Development Hub -

US Consumer Bank

Explore opportunities with an innovative, dynamic team.

January 04, 2024 Article Location overview Hub -

Employee Story

Exploring new challenges, led Foundation Apprentice Emily to a tech career she loves

January 05, 2024 Article Culture Early Careers - Apprentice Related Content - EC -

From intern to graduate: Soohan’s journey in Barclays, Hong Kong

From intern to graduate: Soohan’s journey in Barclays, Hong Kong

January 08, 2024 Article People Stories Culture Hub -

Malcolm, Group Chief Controls Officer

Discover more about CCO from Malcolm, who's a Group Chief Controls Officer.

January 08, 2024 Article People Stories Culture Hub -

Nano, Investment Banking, Assistant Vice President

Learn more about Investment Banking in Barclays Japan

January 09, 2024 Article People Stories Culture Hub -

Yosuke, Investment Banking, Assistant Vice President

Hear from Yosuke and why he joined Barclays Investment Bank in Tokyo.

January 10, 2024 Article People Stories Culture Hub -

Tatsuya, Banking, Managing Director

Discover more about Investment Banking in Barclays Japan.

January 11, 2024 Article People Stories Culture Hub -

Tatsuya,投資銀行部門

日本のバークレイズの投資銀行部門について

January 22, 2024 -

奈乃, 投資銀行部門, アシスタント・ヴァイスプレジデント

日本のバークレイズの投資銀行部門について

January 24, 2024

Date live:

Apr. 26, 2024

Business Area:

COO & Functions

Area of Expertise:

Risk and Quantitative Analytics

Reference Code:

90387615

Contract:

Permanent

Where will you be located?

Take a look at the map to see what’s nearby. Train stations & bus stops, gyms, restaurants and more.

Explore locationJob Title : VP - Retail Credit Risk Review Group

Location: Noida

About Barclays

Barclays is a British universal bank. We are diversified by business, by different types of customers and clients, and by geography. Our businesses include consumer banking and payments operations around the world, as well as a top-tier, full service, global corporate and investment bank, all of which are supported by our service company which provides technology, operations and functional services across the Group.

Risk and Control Objective

Take ownership for managing risk and strengthening controls in relation to the work you do

Working Flexibly

We’re committed to providing a supportive and inclusive culture and environment for you to work in. This environment recognises and supports ways to balance your personal needs, alongside the professional needs of our business. Providing the opportunity for all our employees, globally to work flexibly empowers each of us to work in a way that suits our lives as well as enabling us to better service our customers’ and clients’ needs. Whether you have family commitments or you’re a carer, or whether you need study time or wish to pursue personal interests, our approach to working flexibly is designed to help you balance your life. If you would like some flexibility, then please discuss this with the hiring manager, and your request will be reviewed subject to business needs.

Hybrid Working

Structured hybrid role:

At Barclays, we offer a hybrid working experience that blends the positives of working alongside colleagues at our onsite locations, together with working from home. We have a structured approach where colleagues work at an onsite location on fixed, ‘anchor’, days of the week, for a minimum of two days a week or more, as set by the business area (or nearest equivalent if working part-time hours). Please discuss the working pattern requirements for the role you are applying for with the hiring manager. Please note that as we continue to embed our hybrid working environment, we remain in a test and learn phase, which means that working arrangements may be subject to change on reasonable notice to ensure we meet the needs of our business.

Introduction:

The VP of BBDE Retail Loan Review is based in Noida, India and is an important part of the Retail Loan Review team, which independently evaluates the effectiveness of the Bank’s credit assessment and measurement systems and processes, including the credit risk grading system, provides regular independent assessment of retail credit risk, helping the BBDE Board and Senior Management understand and monitor portfolio quality. The RLR function has a mandate through the BBDE Board Risk Committee and Group Chief Risk Officer. The function sits within the 2nd Line of Defence (2LOD) but is independent of any other 2LOD teams, especially of the Credit Risk teams at BBDE. The RLR function is subject to and compliant with the US SR 20-13 Interagency Guidance on Credit Risk Review Systems.

What will you be doing?

• Act as Lead reviewer for RLR Reviews.

• Communicate the documents to be submitted to RLR by the first and second line of business teams.

• Review the submitted documents, prepare the list of points for further analysis and discuss them within the review team. Prepare initial and follow-up questions for first and second line team management. Schedule necessary discussions with first and second line team management over the duration of the review.

• Conduct analysis to assess the materiality of any concerns that arise during the review, and which may translate to issues or recommendations. Agree issue resolution timeline with action owners, based on the scale of work required to remediate the issue, as well as the materiality of the issue. Escalate disagreements to Director RLR if necessary.

• Draft the review report including all necessary backups.

• For any issues highlighted in the report, recommend issue closure upon successful resolution.

• Lead the team’s independent portfolio data mining and analytics capabilities. Take part in the continuous monitoring of the Retail portfolios through data analysis, portfolio & segment trends.

• Support the development of RLR’s Annual Review Plan.

• Drive regular updates of the RLR Operating Procedures for approval by Director RLR and Head CRRG.

• Act as a deputy to the Head of RLR and support all other team activities. Help career development and training for junior unit members.

What we’re looking for:

• Comprehensive experience as a risk manager of retail credit.

• This role faces off primarily with US-based stakeholders, and requires a significant overlap with US hours. On average the person is expected to work till 10 pm India time, and even later if required.

Skills that will help you in the role:

• Minimum of 10 years of financial services experience in retail (i.e. consumer) credit, including credit cards and track record of successful management of teams involved in credit risk or audit.

• Strong interpersonal skills, including effectively influence and manage internal stakeholders.

• Proficient with verbal and written communication – communicate clearly and professionally through a variety of means, including voice and non-voice communication.

• Ability to work and react quickly, proactively and independently and maintain a consistent workload.

• Team work – have the ability to engage with peers and stakeholders to achieve the best solutions and quality of outcomes.

• Independent analytical thinker, able to effectively articulate and defend own views and decisions.

• Quantitative educational background or professional experience.

• Ability to work remotely, as the role is based in India with team members and most stakeholders / counterparties are based in USA.

• CPA/CA, MBA, CFA, FRM or related qualifications.

• Lending decision making – analyse and interpret relevant data and underwriting policies and procedures to make sound decisions which drive positive customer outcomes.

• Commercial acumen – understanding of a Cards business and its P&L drivers.

Where will you be working?

Noida

Be More at Barclays

At Barclays, each day is about being more – as a professional, and as a person. ‘Be More @ Barclays’ represents our core promise to all current and future employees. It’s the characteristic that we want to be associated with as an employer, and at the heart of every employee experience. We empower our colleagues to Be More Globally Connected, working on international projects that improve the way millions of customers handle their finances. Be More Inspired by working alongside the most talented people in the industry, and delivering imaginative new solutions that are redefining the future of finance. Be More Impactful by having the opportunity to work on cutting-edge projects, and Be More Valued for who you are.

Interested and want to know more about Barclays? Visit home.barclays/who-we-are/ for more details.

Purpose, Values and Mindset

We deploy finance responsibly to support people and businesses, acting with empathy and integrity, championing innovation and sustainability, for the common good and the long term.

Our values underpin everything we do: Respect, Integrity, Service, Excellence and Stewardship.

Respect

We harness the power of diversity and inclusion in our business, trust those we work with, and value everyone's contribution.

Integrity

We operate with honesty, transparency and fairness in all we do.

Service

We act with empathy and humility, putting the people and businesses we serve at the centre of what we do.

Excellence

We champion innovation, and use our energy, expertise and resources to make a positive difference.

Stewardship

We prize sustainability, and are passionate about leaving things better than we found them.

Our Mindset shapes how we take action, living by our Values, driven by our Purpose, always with our customers and clients at the heart of what we do; our Mindset is to Empower, Challenge and Drive.

Empower

Trust and support each other to deliver. Make decisions with those closest to the topic. Include diverse perspectives. Celebrate success and learn from failure.

Challenge

Question whether things can be done better. Use insights based on data to inform decisions. Be curious about how we can adapt and improve. Speak up and be open to alternative viewpoints.

Drive

Focus on outcomes. Deliver with pace. Be passionate and ambitious about what we do. Take personal responsibility. Actively build collaborative relationships to get things done.

More about working at Barclays

We're committed to providing a supportive and simplified experience for our candidates throughout the application and assessment process. Here, you will find information about what to expect and some guidance around your assessment and interview.

While the application process depends on the role, there are some constant steps, which are;

Step 1 - Your application

Step 2 - Your assessment

Step 3 - Your interview

Step 4 - Next steps

We aim to create an inclusive work environment where everyone can reach their full potential. If you require any adjustments to our recruitment process, please click here to learn more.

Find out more information here.

Barclays offers a diverse, inclusive and engaged culture. A place where people can bring their whole selves to work and be respected for who they are, valued for what they do and celebrated for their contribution to our business and our community.

OWe are an equal opportunity employer and opposed to discrimination on any grounds. It is the policy of Barclays to ensure equal employment opportunity without discrimination or harassment on the basis of race, colour, creed, religion, national origin, alienage or citizenship status, age, sex, sexual orientation, gender identity or expression, marital or domestic/civil partnership status, disability, veteran status, genetic information, or any other basis protected by law.

We’re committed to providing a supportive and inclusive culture and environment for you to work in. This environment recognises and supports ways to balance your personal needs, alongside the professional needs of our business. Providing the opportunity for all our employees, globally to work flexibly empowers each of us to work in a way that suits our lives as well as enabling us to better service our customers’ and clients’ needs. Whether you have family commitments or you’re a Carer, or whether you need study time or wish to pursue personal interests, our approach to working flexibly is designed to help you balance your life. If you would like some flexibility then please discuss this with the hiring manager.

The Barclays Way

This is the spirit of Barclays. It’s why we exist, what we believe and how we behave. But most importantly, it’s how we make decisions, take action and get things done.

Purpose

Working together for a better financial future.

Values

We believe great talent RISES. It acts with Respect, Integrity, Service, Excellence and Stewardship.

Mindset

We discover our full potential through our desire to Empower, Challenge and Drive each other.